Informative tax planning, preparation, and accounting related information and articles we think you may find of interest.

CLAREMONT MANAGEMENT NEWS

Maria V. Huja, EA, has been promoted to Managing Partner. Maria, who joined the firm in 2009, has played a critical role in Claremont’s growth and success over the past 16 years. A graduate of DePaul University with Honors, Maria earned her Enrolled Agent (EA) designation the same year she began her career at Claremont.

GET AN IRS IP PIN

With the rise of tax return-related identity theft, we strongly urge all of our clients to take advantage of the IRS Identity Protection PIN program. In fact, we even put together a simple, step-by-step guide that explains how the process works. Getting an IP PIN is one of the most important measures available to ensure that a fraudster cannot file a false tax return in your name.

GET TAX-FREE SUPPER MONEY

Are you and/or your staff required to work overtime occasionally? If so, both you and your employees may be entitled to tax-free supper money. What’s more, even sole proprietors can take advantage of this fringe benefit, just like partnerships and corporations with employees, as long as the IRS conditions are met.

ENERGY AND VEHICLE CREDITS

If you purchased an electric vehicle (EV) or fuel cell electric vehicle (FCV), or made qualified energy-efficient improvements to your home, such as installing solar panels, energy-efficient windows, or upgrading your HVAC system, you may be entitled to a tax credit.

STANDARD VS. ITEMIZED DEDUCTION

One of the most common questions people have is whether they should take the standard deduction or itemize their deductions. As a general rule, you should itemize deductions if the allowable itemized deductions are greater than you would receive with the standard deduction. However, there are other factors to consider and not every taxpayer is eligible to use the standard deduction.

HIGH INCOME TAXPAYERS

As a high income taxpayer, tax planning is essential. Our informative new handout (in PDF format) covers topics, such as capital gains, retirement accounts, education benefits, the child tax credit, medicare taxes, and more.

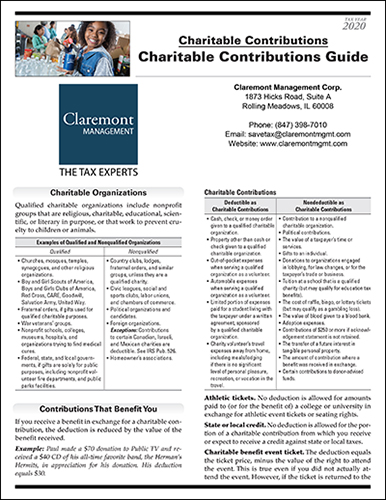

TRACK YOUR CHARITABLE CONTRIBUTIONS

Claremont Management has put together an informative guide (in PDF format) to help you keep track of charitable contributions this year.

ESTIMATED TAXES

This handout (in PDF format) explains how estimated taxes work, who has to pay estimated taxes and who does not, when they are due, penalties for underpayment, and more.

WHY YOU SHOULD HAVE AN ENROLLED AGENT PREPARE YOUR TAXES

Enrolled agents (EAs) are America's tax experts. They are the only federally-licensed tax practitioners who both specialize in taxation and have unlimited rights to represent taxpayers before the Internal Revenue Service.

TEN IRS TIPS FOR CHOOSING A TAX PREPARER

The IRS warns taxpayers should choose their tax return preparer wisely. This is because taxpayers are responsible for all the information on their income tax return. That’s true no matter who prepares the return.

Secure Client Login

Secure Client Login